Maximize Earnings with 100 Commission Real Estate Strategies

The Modern Shift to 100% Commission Real Estate

The real estate landscape is changing. How agents earn their living is evolving, moving away from traditional commission splits towards 100% commission models. This isn't just about keeping more of your earnings; it's a fundamental shift in how agents and brokerages interact. It's about empowering agents to take the reins of their careers and finances.

Understanding the 100% Commission Model

Traditional brokerages often operate on commission splits, sometimes as high as 50/50 or 70/30. This means agents relinquish a portion of their gross commission income (GCI). Let's look at an example: a $500,000 home sale with a 3% commission generates a $15,000 GCI. In a 70/30 split, the agent receives $10,500. With a 100% commission model, the agent keeps the entire $15,000, typically paying a flat transaction fee or a monthly desk fee to the brokerage.

This difference significantly impacts an agent's income. It also fosters a sense of entrepreneurial independence. The rise of 100% commission brokerages, particularly in the U.S., represents a departure from traditional practices. This model offers greater financial rewards for agents and encourages them to take ownership of their business expenses and marketing. The increasing availability of digital tools and MLS data has further facilitated this trend, allowing agents to operate more independently. This shift suggests a larger structural change in real estate, as agents seek greater autonomy and control over their earnings. For a deeper dive into the pros and cons, you can learn more about 100% commission structures.

Different Structures Within the 100% Model

While the premise of keeping 100% of your commission remains constant, different brokerages implement the model with varying fee structures:

- Monthly Desk Fees: Agents pay a recurring monthly fee for office space, technology, and branding.

- Transaction Fees: Agents pay a flat fee per closed transaction, regardless of the final sale price. This can range from a few hundred dollars to a small percentage.

- Hybrid Approaches: Some brokerages combine both models with a lower monthly fee and a smaller per-transaction fee.

Each structure has its own financial implications. Agents should carefully consider their projected sales volume and average sale price when selecting the right fit. As you consider transitioning to a 100% commission model, explore how real estate can contribute to your overall wealth-building strategy.

Debunking Myths and Addressing Challenges

A common misconception is that 100% commission brokerages offer limited support. In reality, many provide robust training, marketing resources, technology platforms, and administrative support. The higher earning potential also allows agents to invest more in their own business development and lead generation.

However, this model does present challenges. Agents are responsible for all aspects of their business, including marketing, lead generation, administration, and technology. This requires discipline, strong organizational skills, and a proactive approach. Success in this model means being your own marketing team, tech support, and business manager. It requires a proactive approach to business planning, financial management, and consistent client outreach.

To illustrate the key differences, let's compare the traditional and 100% commission models:

Traditional vs. 100% Commission Models

This table compares key aspects of traditional brokerage models against 100% commission models to highlight the fundamental differences.

| Feature | Traditional Brokerage | 100% Commission Brokerage |

|---|---|---|

| Commission Structure | Split with brokerage (e.g., 70/30, 50/50) | Agent keeps 100% |

| Brokerage Fees | Typically covered within the commission split | Monthly desk fee, transaction fee, or hybrid |

| Agent Income | Lower initial income due to split | Higher potential income after fees |

| Agent Responsibilities | Varies depending on brokerage | Greater responsibility for marketing, lead generation, and administration |

| Support and Resources | Often more provided by brokerage | Can vary, but many offer comparable resources |

As shown in the table, while the 100% commission model empowers agents to retain more of their earnings, it also requires them to take on more responsibility for their business operations. Choosing the right model depends on your individual work style, business goals, and financial projections.

The Evolution of Real Estate Compensation

The real estate industry has seen a fascinating shift in how agents earn their living over the last century. Understanding this evolution provides valuable insight into the rise of 100% commission real estate and its potential impact on the future of the industry. Real estate transactions initially involved small fees, a stark contrast to today’s structured commission percentages. The journey from these modest beginnings reveals a complex interplay of market dynamics, technology, and evolving consumer expectations.

Early Commission Structures and the Rise of Standardization

The history of real estate commissions paints a picture of significant change. In the 1920s, the average commission was around 2.5% of the sale price, split between the buyer’s and seller’s agents. For a $10,000 house, this translated to a $250 total commission, with each agent receiving $125.

By 1940, commissions had climbed to approximately 5% in some markets as organizations like the National Association of Realtors (NAR) promoted homeownership. This 5-6% rate has remained, despite challenges and discussions, solidifying its place as a standard feature of traditional real estate transactions in the U.S. Learn more about this topic. This standardization of commissions around the mid-20th century signaled a fundamental change, reinforcing the real estate agent's role as a vital link in property transactions.

The Impact of Technology and Changing Consumer Needs

However, this traditional model encountered increasing pressure as technology began to reshape the real estate landscape. The internet provided buyers and sellers with direct access to information previously controlled by agents. Online listing platforms, property search engines, and digital communication tools fundamentally changed how people bought and sold homes.

This increased transparency and access to data prompted some to question the traditional commission structure. Consumers began to demand more value, pushing some agents and brokerages to explore alternative compensation models. This is where the idea of 100% commission real estate started gaining attention. It offered an attractive alternative for agents wanting greater control over their earnings and for consumers seeking more flexible choices.

The Emergence of 100% Commission Real Estate

100% commission real estate presents a new approach. It enables agents to keep their entire commission while paying a flat transaction fee or a monthly desk fee to their brokerage.

This model offers agents potentially higher earnings and more freedom in managing their business. It mirrors a broader movement towards entrepreneurship and autonomy within the real estate profession. This structure also addresses the evolving needs of consumers who are more focused on price and seeking services that offer greater value. This shift holds notable implications for the future of the industry, possibly influencing how all agents organize their businesses. The evolution of commissions is ongoing, with 100% commission models representing a potentially substantial force in real estate's future.

The Real Numbers Behind 100% Commission Models

Beyond the allure of keeping all your commission, it's essential to thoroughly evaluate the financial impact of 100% commission real estate. This means digging deeper than the surface and truly understanding what it means financially for agents at different production levels.

Comparing Income Across Models

Let's analyze how income shifts under different models. We'll compare traditional commission splits (like the common 70/30 split) with monthly fee structures and per-transaction fee models often seen in 100% commission brokerages. For example, imagine an agent closing five transactions per month, each averaging $500,000, with a 3% commission. This generates $75,000 in gross commission income. Under a traditional 70/30 split, the agent takes home $52,500. With a 100% commission model and a $500 monthly fee, the agent keeps almost all of the $75,000, just subtracting the fee.

However, this simplified example doesn't consider all expenses. This is a common pitfall for agents new to 100% commission models.

To illustrate further, let's examine a potential income comparison:

Income Comparison Across Commission Models

This table shows potential earnings at different sales prices and transaction volumes under traditional vs. 100% commission structures

| Transaction Details | Traditional Split (70/30) | 100% Commission (Monthly Fee) | 100% Commission (Per Transaction Fee) |

|---|---|---|---|

| 5 Transactions at $500,000 each (3% Commission) | $52,500 | $74,500 ($500 Monthly Fee) | $70,000 ($500/Transaction Fee) |

| 10 Transactions at $500,000 each (3% Commission) | $105,000 | $149,500 ($500 Monthly Fee) | $140,000 ($500/Transaction Fee) |

| 5 Transactions at $300,000 each (3% Commission) | $31,500 | $44,500 ($500 Monthly Fee) | $40,000 ($500/Transaction Fee) |

As you can see, the 100% commission model, particularly with a low monthly fee, can significantly boost agent income, especially with higher transaction volumes and sales prices. However, remember that these calculations don't include additional business expenses which must be factored in for a complete picture.

Factoring in the True Cost of 100% Commission

A critical factor is determining your breakeven point. This is the transaction volume where a 100% commission truly becomes more profitable. It's vital to account for commonly overlooked expenses, like:

- Marketing

- Technology (like a CRM)

- Business development

These are now the agent’s responsibility. For instance, if marketing costs $1,000 per month and CRM software costs $200 monthly, these must be deducted from the agent’s 100% commission earnings.

Additionally, consider costs like health insurance, retirement contributions, and professional development, often partially covered by traditional brokerages, but now fall entirely on the agent.

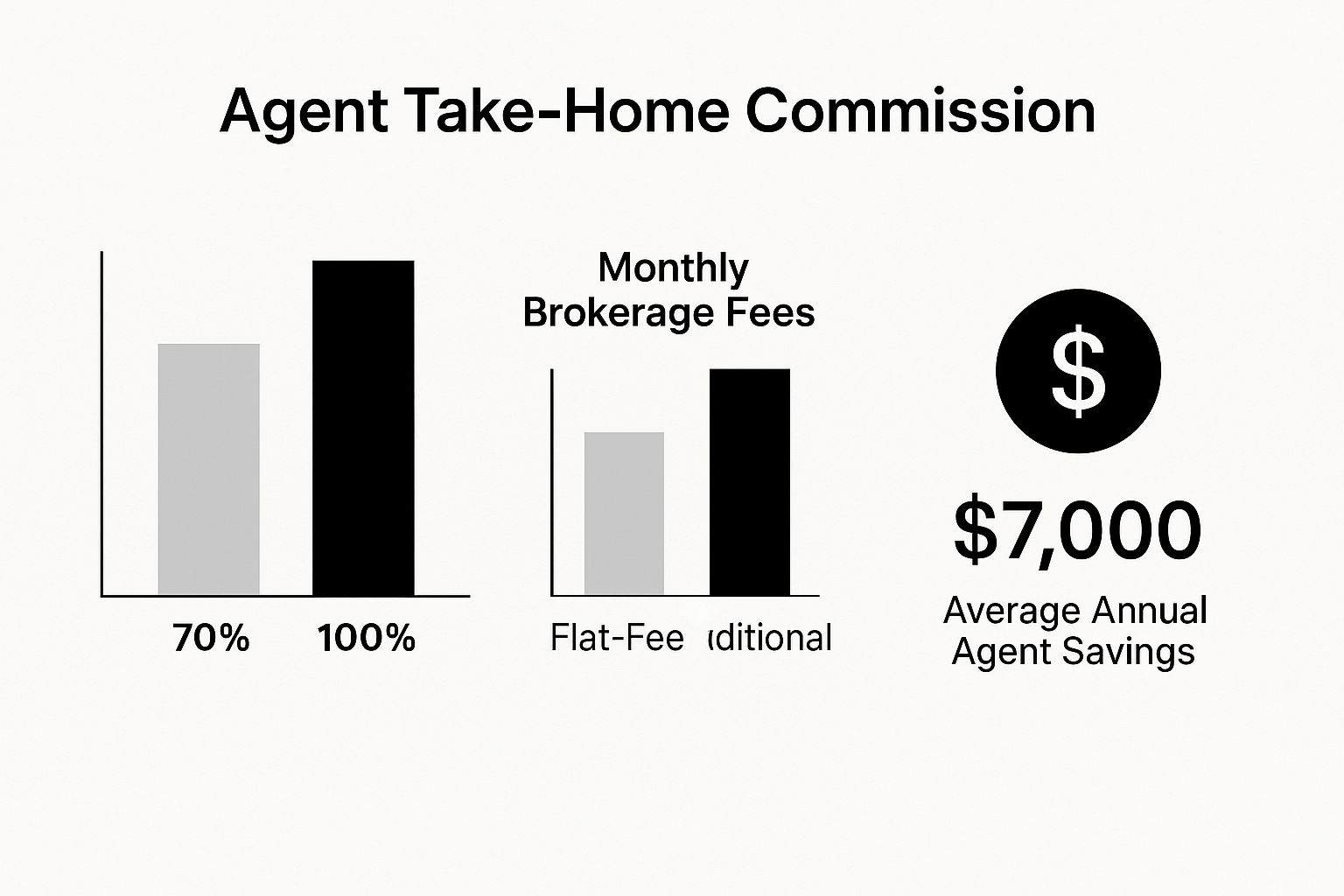

This infographic illustrates potential financial benefits of switching to a 100% commission structure, showcasing substantial increases in take-home pay and annual savings. This can be particularly attractive in competitive markets where maximizing income is a primary goal.

Financial Modeling for Your Business

Through thorough financial modeling, you can determine if these models truly deliver on their income promises for your specific production level and business strategy. Build a detailed spreadsheet outlining your potential income at different sales prices and transaction volumes. Compare various 100% commission structures against your current brokerage model. This analysis provides crucial clarity, empowering you to make informed choices based on your unique needs. Market dynamics, particularly current pricing trends, significantly influence commission income. Understanding market conditions and average sales prices are crucial for projecting income potential. For a deeper dive into current real estate statistics, visit the National Association of Realtors research page.

The Unfiltered Truth About 100% Commission Real Estate

The appeal of 100% commission real estate is strong. Keeping every dollar earned is a powerful draw for many agents. But it's important to understand the complete picture of this model, including both its advantages and challenges.

The Promise of Autonomy and Income

A major advantage of 100% commission is the autonomy it provides. Agents control their business, from setting hours to choosing marketing strategies. This freedom can be incredibly empowering. The income potential is also significant.

Without a traditional split, agents keep all their earnings. This allows them to potentially reinvest more in their businesses. For example, on a $750,000 property with a 3% commission, an agent earns $22,500. In a 70/30 split, they'd take home $15,750. With 100% commission, they keep the full $22,500, less any transaction or desk fees. This additional income can significantly boost business growth.

The Reality of Self-Management

This autonomy also brings significant responsibility. Agents become their own marketing, tech support, and business management team. They handle everything from lead generation and client management to accounting and administrative tasks.

This can be a heavy workload, especially for those used to brokerage support. Agents in this model need to be organized, self-motivated, and skilled in various business areas. Success requires strong time management and effective marketing strategies.

Unveiling the Unexpected Considerations

Beyond finances, other factors deserve attention. The 100% commission structure can build entrepreneurship and professional pride. The direct link between effort and income is motivating. However, the lack of a traditional office can sometimes feel isolating.

Building a strong network is crucial. The fluctuating income of commission-based work can also be stressful, so careful financial planning is essential. Agents also manage their own benefits, like health insurance and retirement. Considering these factors will help you decide if 100% commission real estate aligns with your goals.

The Ideal Candidate for 100% Commission Success

Not every real estate agent thrives in a 100% commission model. While the appeal of keeping your entire commission is strong, this structure requires a particular skill set and mindset. By examining successful agents at 100% commission real estate brokerages, we can identify the common traits that predict success.

Essential Traits and Skills

Top earners in this model consistently demonstrate strong business acumen. They understand the real estate market dynamics, accurately forecast income and expenses, and make informed financial choices.

Self-discipline is also essential. Without the structure of a traditional brokerage, agents must manage their own schedules, prioritize tasks, and maintain motivation.

Effective marketing capabilities are crucial. Agents in this model are responsible for generating their own leads. This necessitates a proactive approach to marketing, including online advertising, social media engagement, and networking.

Finally, strong network development is key. Building relationships with other professionals, such as lenders and title companies, can generate referrals and valuable partnerships.

Adapting Different Personality Types

Interestingly, diverse personality types can find success within 100% commission real estate. Highly organized and detail-oriented individuals often excel at managing administrative tasks and self-promotion.

More extroverted personalities can leverage their networking abilities to build a robust referral base. Ultimately, success hinges on adapting your strengths to this unique structure.

Preparations for Transitioning Agents

Many agents switching to 100% commission undertake specific preparations. Building financial reserves is a common strategy. This safety net cushions the initial transition period, when income can fluctuate.

Another key preparation is refining marketing strategies. Agents invest time developing a strong online presence and building relationships within their community. They often establish clear business plans and financial objectives, preparing to operate like independent business owners.

Self-Assessment Framework

Before making the leap, assess your compatibility with a 100% commission structure. Consider your experience level. Are you comfortable handling all aspects of a transaction independently?

Evaluate your current skill set. Are you proficient in marketing, lead generation, and financial management? Finally, examine your work style. Do you thrive in an autonomous environment, or do you prefer the support of a traditional brokerage? Honest self-reflection will help determine if 100% commission real estate aligns with your career goals.

Proven Strategies for 100 Commission Dominance

For agents committed to maximizing their earnings in the 100% commission real estate model, proven strategies distinguish top performers. This section explores actionable approaches used by successful agents, focusing on business planning, financial management, and lead generation.

Mastering Business Planning and Financial Management

Effective business planning is paramount. A well-defined business plan acts as a roadmap, outlining clear goals, target markets, and marketing strategies. It guides your decisions and actions, including projecting income, managing expenses, and reinvesting strategically.

Financial management is equally vital. In a 100% commission model, agents are responsible for all business expenses. This requires meticulous tracking of income and expenses, creating a realistic budget, and maintaining financial reserves. Setting aside a portion of each commission for taxes, marketing, and business development ensures financial stability.

Creating a Predictable Lead Flow

Generating consistent leads is essential for any real estate business. Without brokerage-provided leads, agents must create their own predictable lead flow. This involves a multi-faceted approach.

- Targeted Marketing: Focusing marketing efforts on specific demographics or property types increases efficiency.

- Digital Presence: A strong online presence, including a professional website and active social media engagement, is crucial.

- Networking: Building relationships with other professionals, attending community events, and engaging in local organizations expands your network and referral opportunities.

These combined strategies build a robust pipeline of potential clients.

Building a Support Network and Leveraging Technology

While 100% commission agents operate independently, a strong support network is invaluable. Connecting with other 100% commission agents provides a platform for sharing best practices and overcoming challenges. Mentorship programs or coaching services also offer valuable guidance.

Technology plays a crucial role. Utilizing a Customer Relationship Management (CRM) system streamlines client communication and manages transactions efficiently. Investing in other relevant technologies, like virtual tour platforms and marketing automation tools, enhances client services and overall business efficiency.

Addressing Common Challenges

100% commission real estate presents unique challenges. Inconsistent income streams require careful budgeting and financial planning. Maintaining motivation without a traditional office environment necessitates self-discipline and proactive engagement with your support network.

Building a personal brand that resonates with clients is also crucial. This involves developing a unique value proposition and fostering strong client relationships. Consistent branding across all platforms reinforces your professional image.

By implementing these proven strategies and addressing the challenges, agents can achieve 100 commission dominance in the competitive real estate market.

Making the Leap to 100% Commission Real Estate

Transitioning to a 100% commission real estate model represents a significant career shift. This section offers a roadmap for a smooth and successful transition, encompassing everything from brokerage evaluation to client relationship management.

Evaluating 100% Commission Brokerages

Not all 100% commission brokerages are created equal. When contemplating a change, diligently compare fee structures. Some brokerages may impose monthly desk fees, while others might favor per-transaction fees, or even employ a hybrid approach. For instance, a $500 monthly fee versus a $200 per-transaction fee can substantially influence your net income, particularly if your transaction volume fluctuates.

Beyond fees, scrutinize the support services provided. While the 100% commission model emphasizes agent autonomy, vital support such as training, marketing resources, and technology platforms can be essential, especially for newer agents. Lastly, consider company culture. A supportive and collaborative environment can significantly contribute to your overall job satisfaction and professional achievements.

Building Financial Reserves

Before making the transition, establish a solid financial footing. Maintaining financial reserves is paramount. This safety net offers stability during the initial phase when income might be variable. Calculate your projected expenses for at least three to six months, incorporating both business costs like marketing and technology, as well as personal expenses. Possessing this financial cushion empowers you to concentrate on developing your business without the immediate burden of financial strain.

Managing Client Relationships During the Transition

Preserving strong client relationships is crucial. Open and transparent communication regarding your transition is key. Articulate the advantages of the new structure, such as your enhanced capacity to deliver more personalized service and potentially more competitive pricing.

Prepare communication templates to address client inquiries professionally and uniformly. Consider formulating specific transition protocols for ongoing transactions, ensuring a seamless experience for your clients. This proactive strategy helps sustain trust and fortify existing client relationships. To further refine your approach, explore strategies employed by elite real estate agents.

Making the switch to 100% commission necessitates planning and preparation. By thoroughly evaluating brokerages, establishing financial reserves, and proactively managing client relationships, you can position yourself for greater success within this model. Interested in exploring a 100% commission structure that prioritizes agent development and provides a supportive atmosphere? Visit Ashby & Graff Careers to learn more and initiate your application.